Mission & Vision

Natural disasters are a major impediment to development in many countries, undermining sustainable development, threatening earlier achievements in poverty alleviation and leading to loss of lives and livelihoods. With climate change extreme weather events such as floods, storms and droughts are expected to increase in frequency and intensity. Aid often comes too little, too late – around one to six months after the disaster has struck - increasing the impacts of natural disasters by twofold and more. As an essential element of comprehensive risk management, climate risk insurance can mitigate the negative consequences providing reliable and fast financial support in the aftermath of extreme weather events.

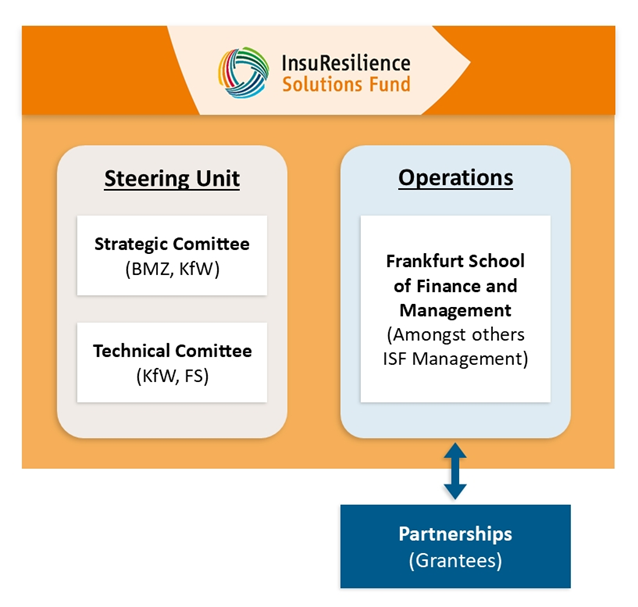

The mission of the InsuResilience Solutions Fund (ISF) is to support innovative solutions to mitigate these negative impacts of climate change. Therefore ISF fosters the development of needs-based and financially sustainable climate risk insurance products in developing and emerging countries, increasing the resilience of poor and vulnerable households against extreme weather events and natural catastrophes. As implementing programme of the InsuResilience Global Partnership, the ISF is an important contribution of the German Government to achieve the target of the international initiative on climate risk insurance, or 'InsuResilience'. The ISF further serves as an implementation vehicle for the Tripartite Agreement; for this purpose, the Project Coordination Unit (PCU) has been established.

For more information visit Frankfurt School’s website.

Background

The economic and financial losses caused by natural disasters have increased substantially over the last decades. It is expected that the frequency and severity of weather related events will further increase due to climate change. Developing and emerging countries are and will be particularly affected by these developments. Their capacities to cope with the effects of natural disasters and extreme weather events are limited. Traditional risk-sharing mechanisms and social safety nets fail by reason of the scale and effect of such catastrophic events. Access to insurance is limited in developing economies although insurance could effectively complement existing risk management strategies and reduce the vulnerability of countries and their population towards natural catastrophes. Insurance schemes reduce the dependence on public emergency assistance and compensate the affected in a direct way. Insurance pay-outs reach people much faster than emergency relief operations and more importantly, insurance can incentivize people to implement effective adaptation measures by leading to a reduction of the payable insurance premium.

The ISF's approach is unique as it aims to leverage the expertise of the private sector including risk taking capacities and to ensure the demand and sustainability of the developed climate risk insurance products.

The ISF seeks to increase the capacity of developing countries to adapt to climate change through the introduction and use of climate risk insurance products by

- supporting comprehensive climate risk analysis as a vital basis for governments, businesses and households to become more proactive risk managers and take informed decisions in defining needs-based climate risk management and adaptation strategies. Furthermore the Global Risk Modelling Alliance (GRMA) programme, initiated by the V20 and the insurance Development Forum (IDF) and hosted under the ISF, supports countries in strengthening their own climate risk modelling capabilities and in closing existing risk modelling and data gaps. The programme is implemented by a team of climate risk (finance) experts from the public and the private sector following a unique PPP approach.

- identifying possible concepts and basic structures of climate risk transfers via insurance solutions as an integral element of a comprehensive climate risk management strategy by funding studies on wider adaptation needs based on climate risk analysis.

- supporting the introduction and offer of innovative climate risk insurance products by co-funding the development of concrete insurance products.